NEW Introducing Lending Infra for Consumer Tech Platforms

Enabling Enterprises with the power of Embedded Finance

Transform your Business with Nupay’s Open Banking Infrastructure – Open accounts, enable loans, verify, transact, reconcile and connect to banks.

Automate your banking Build your fintech Engage your customers Improve your customer experience

NEW Introducing Lending Infra for Consumer Tech Platforms

Enabling Enterprises with the power of Embedded Finance

Transform your Business with Nupay’s Open Banking Infrastructure – Open accounts, enable loans, verify, transact, reconcile and connect to banks.

Automate your banking Build your fintech Engage your customers Improve your customer experience

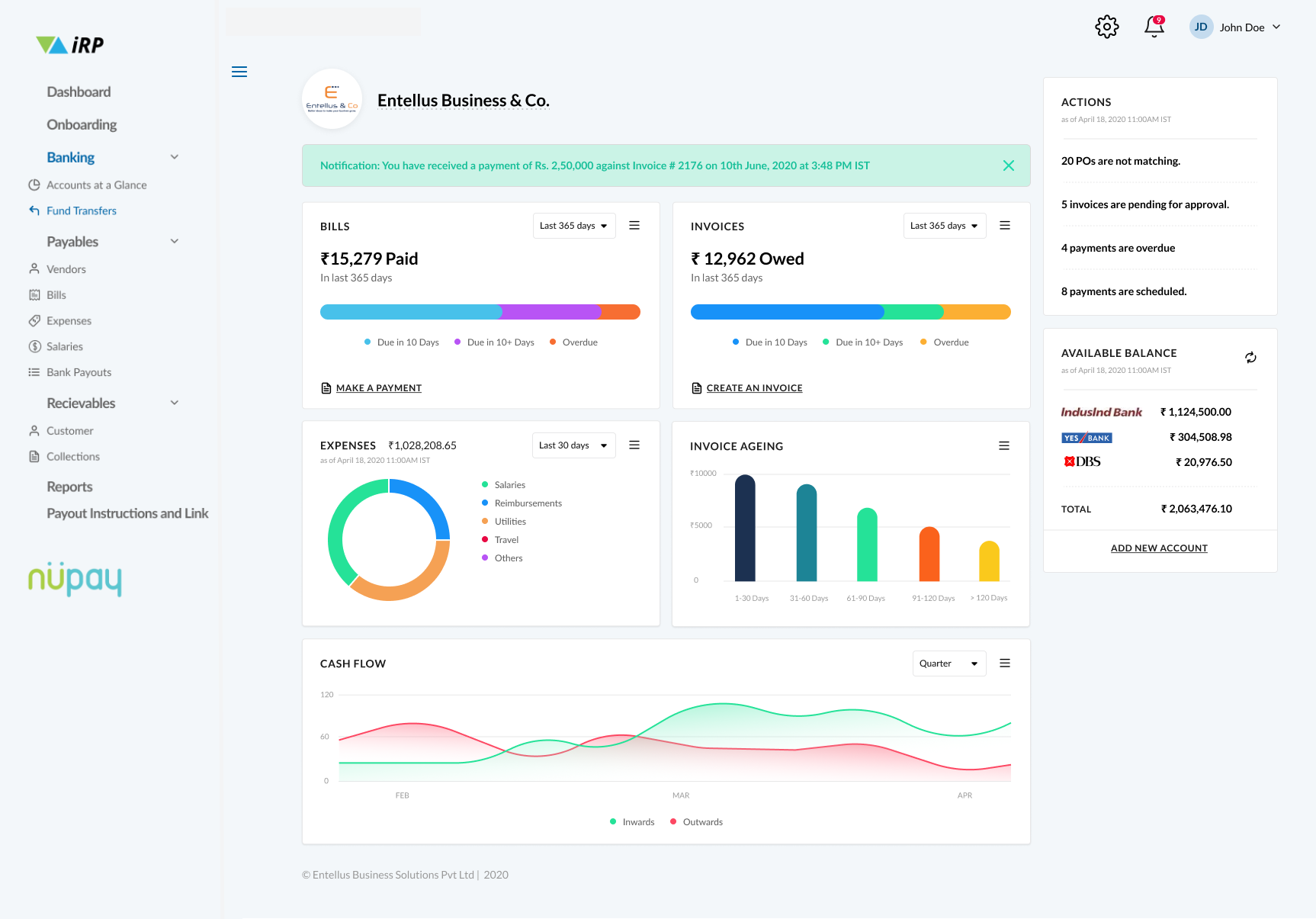

Full Stack API Banking Platform

New Age Digital Banking for Your Business

One-stop solution for enterprises to manage all their banking, payments, lending and reconciliation across multiple banks.

Multi-Bank Connect & Smart Reporting

Link all banks and payment options to get a complete financial view with Advanced AI/ML Capabilities.

Streamline Business Processes

Make all your invoices, receivables, payables, refunds, reconciliations – Straight Through.

Smart and Intuitive

Single User Interface to manage all your banking & payments with ease – Create your workflow and authorise without logging in to bank portals.

API First

Modular architecture with easy to integrate APIs – Create your own platform with our building blocks.

Monetise Your Business

Start opening bank accounts and offer loans, deposits and insurance products with attractive commissions.

Go Live Faster

Select your services and get started in a matter of days, NOT months!

Renew your Business Banking!

Save 50% of your time on Accounts Payable

Reduce Collection TAT by 40%

Increase Payouts success rate by 20%

Join India’s leading companies using Nupay

Join India’s leading companies using Nupay

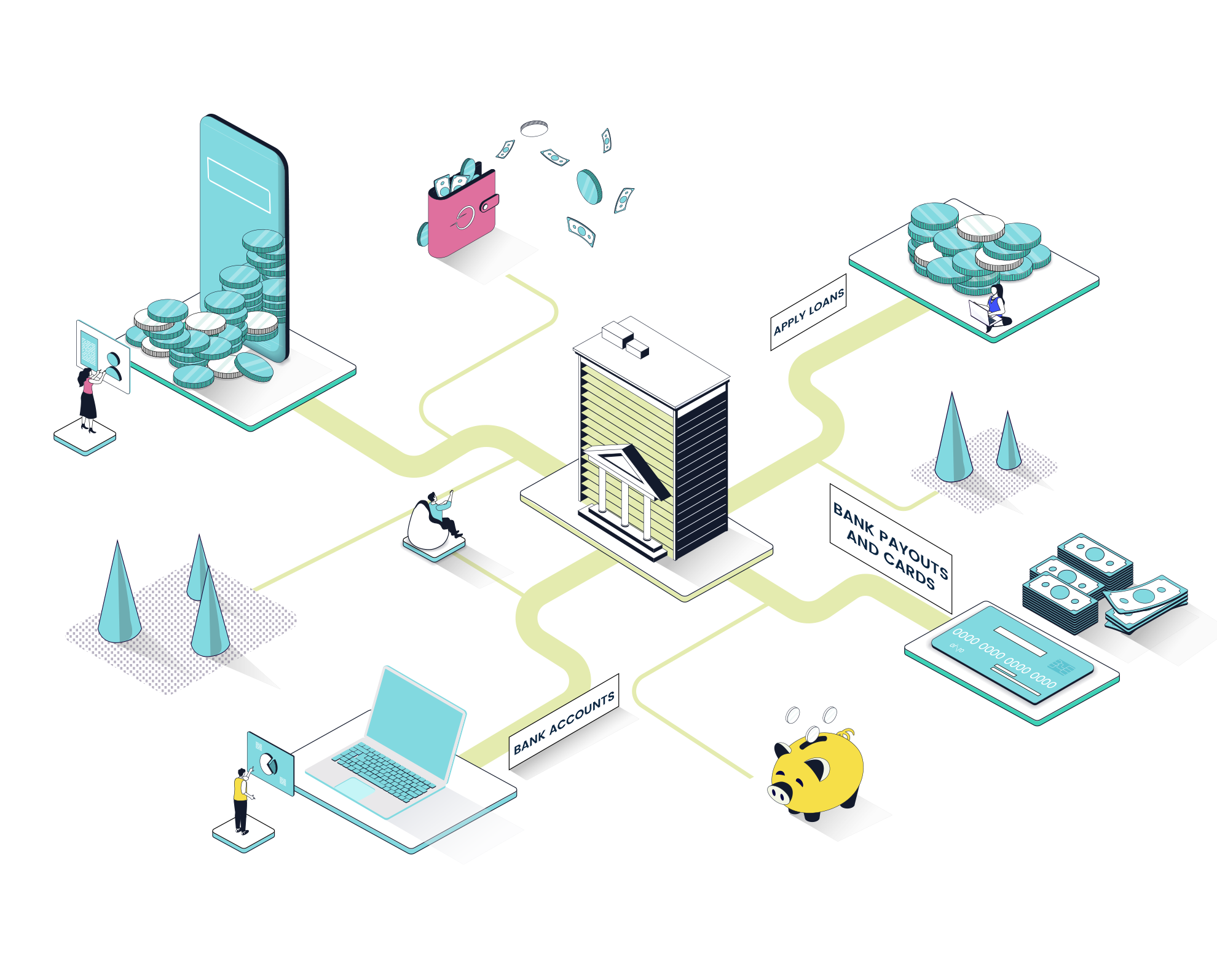

How It Works

Get started on Nupay – Real Fast !

Activate services

Start collecting, making payments or offering loans to your customers

Our Partners

Connecting the financial ecosystem

Start offering bank accounts, loans, deposits and insurance products.

Our Partners

Connecting the financial ecosystem

Start offering bank accounts, loans, deposits and insurance products.

Our Products

Create, send, receive and reconcile invoices, Collect through payment gateway, IMPS / NEFT/ RTGS, and make API-based bank payouts.

Explore More

Automate recurring payments – Physical NACH, eMandates, presentations, UPI Autopay, and BBPS.

Explore More

Embedded Finance

Offer your customer base digital bank accounts, loans, deposits, and other financial products.

Explore More

iRP

Create, Send, Receive and Reconcile Invoices, Collect through Payment gateway, IMPS / NEFT/ RTGS and make API based bank payouts.

Explore More

autoNACH

Explore More

Embedded Finance

Explore More